how to take an owner's draw in quickbooks

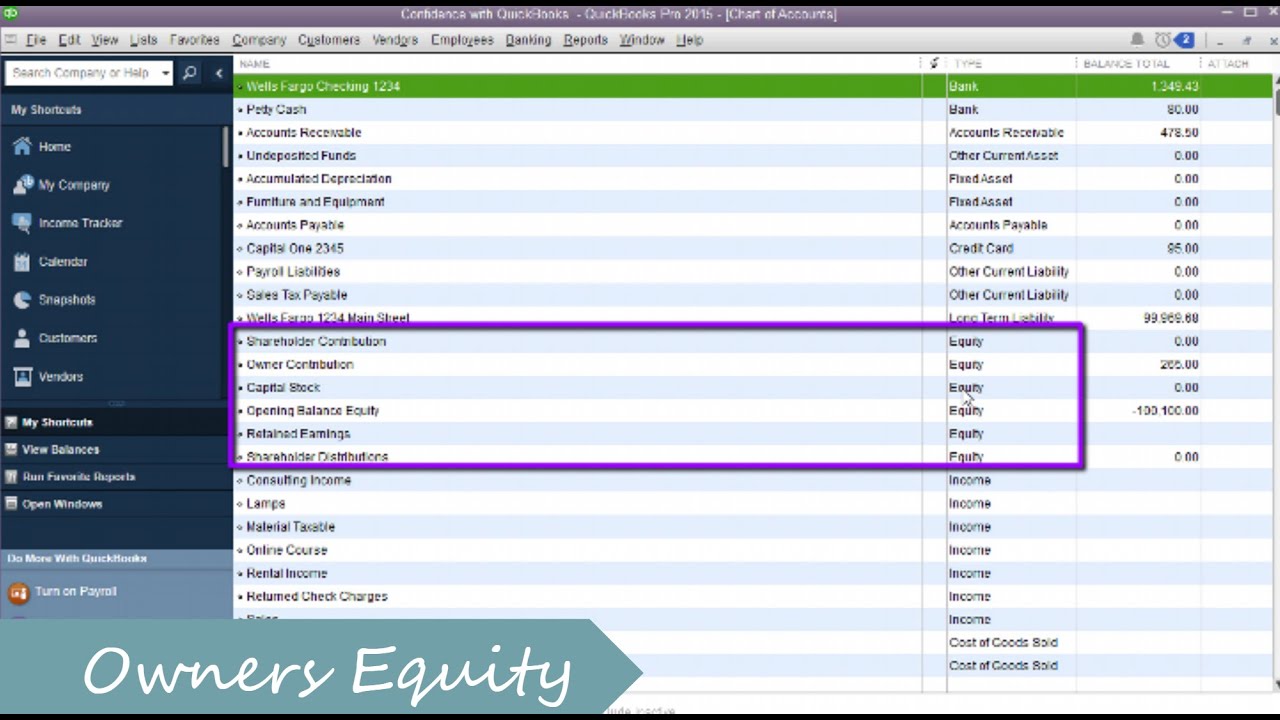

Sole proprietors can take money directly out of their company as an owner draw and use the funds to. Choose Lists Chart of Accounts or press CTRL A on your keyboard.

Quickbooks Tip Applying Owner S Time For Job Costing Long For Success Llc

The most common way to take an owners draw is by writing a check that transfers cash from your business account to your personal account.

. First of all login to the QuickBooks account and go to Owners draw account. Ive got an Owners Equity equity account set up and any time I Take money from my pocket and spend it on the company I log it in this account and categorize it properly for tracking purposes. Dividends are NOT deductible at the corporate level but are taxable to the recipient.

An owner of a C corporation may not. Click the Expenses tab and then select the account category that best fits your needs. In the Chart of Accounts window select New.

To open an owners draw account follow these steps. Select the Bank Account Cash Account or Credit Card you used to make the purchase. 1 They dont have owners.

In this video we demonstrate how to set up equity accounts for a sole proprietorship in Quickbooks. Now you need to. We also show how to record both contributions of capita.

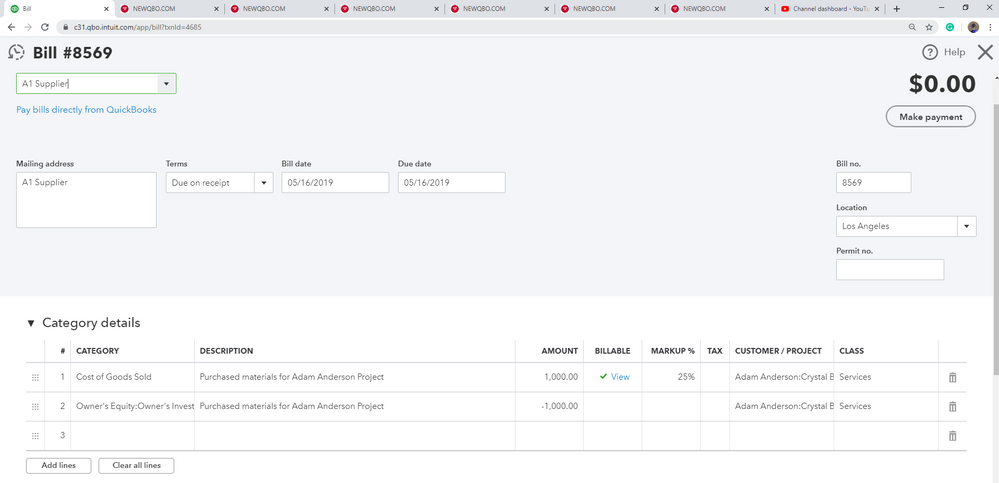

At the end of the year or period subtract your owners draw account balance from your owners equity account total. So a Form 1099-Div should be filed. Record your owners draw by debiting your Owners Draw Account and crediting your Cash Account.

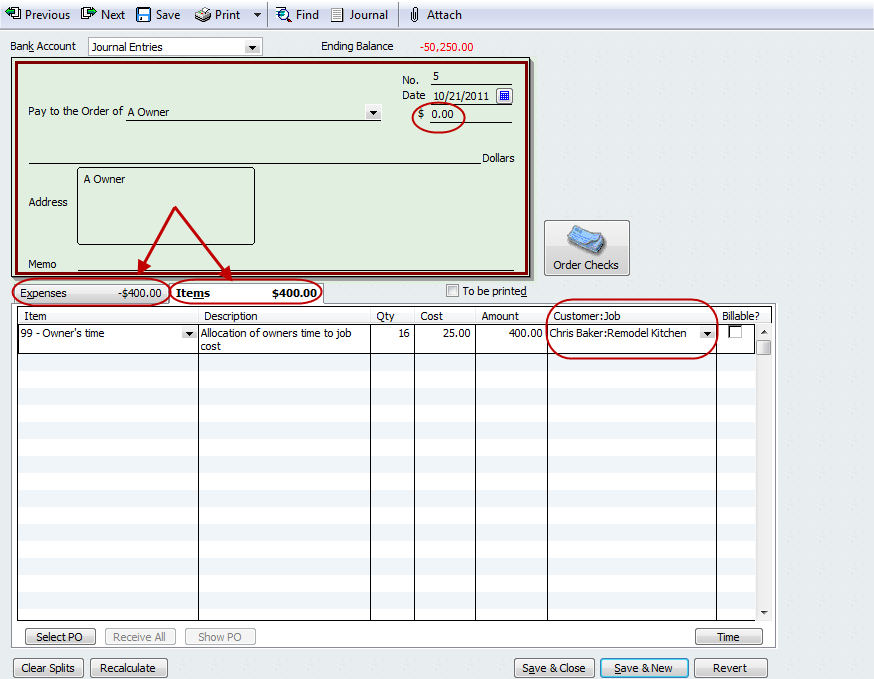

Click Account New at the bottom left. From the Account Type drop-down choose Equity. Go to Banking Write Checks.

S Corporations use Owners equity to show the. Step 5 Enter the total for the withdrawal in the Amount column of the Expenses tab. Learn more about owners draw vs payroll salary and how to pay yourself as a small business owner.

2 The employeesowners ie those that provide services get wages W-2. Click on the Banking and you need to select Write Cheques. Heres how to do it.

3 Money paid out to these owners your description is either a loan or a dividend. Enter the account name and description Owners Draw is recommended. Many small business owners compensate themselves using a draw rather than paying themselves a salary.

At the end of the year or period subtract your Owners Draw Account balance from your Owners Equity Account total. Enter the Amount. Select the Gear icon at the top and then select Chart of Accounts.

Owners draws or withdrawals is never an expense. A draw lowers the owners equity in the business. To create an Equity account.

How do you handle owner draws in QuickBooks. Set up and process an owners draw account Overview. How to Record Owner Draws Into QuickBooks.

You have an owner you want to pay in QuickBooks. Click Save and Close. To record owners draws you need to go to your Owners Equity Account on your balance sheet.

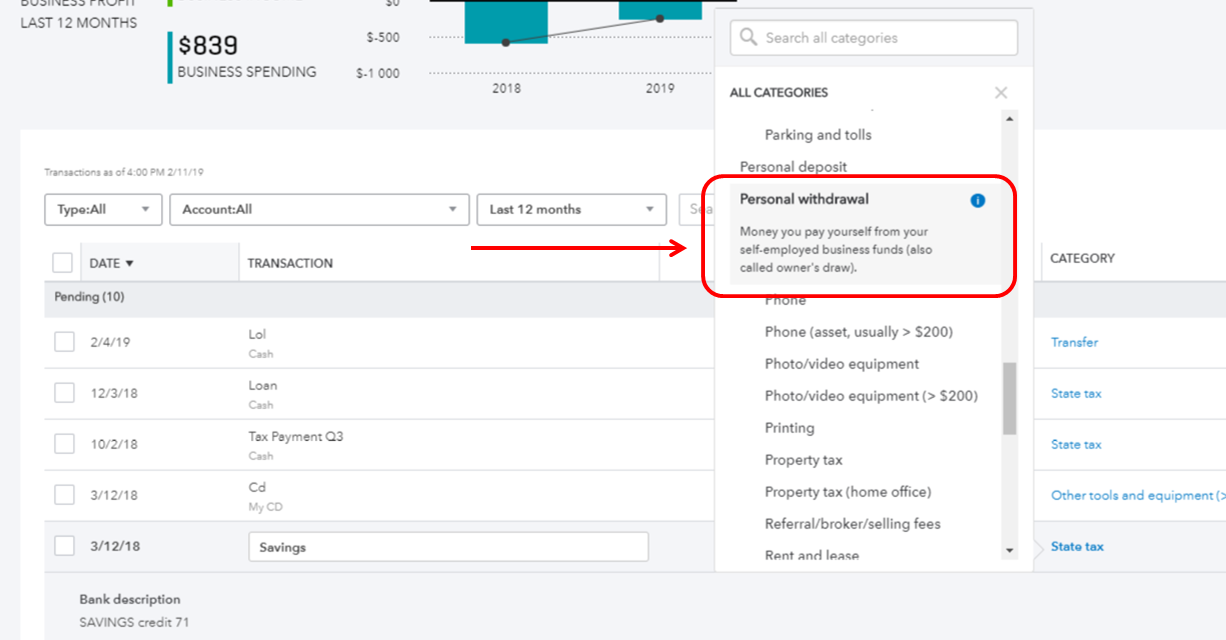

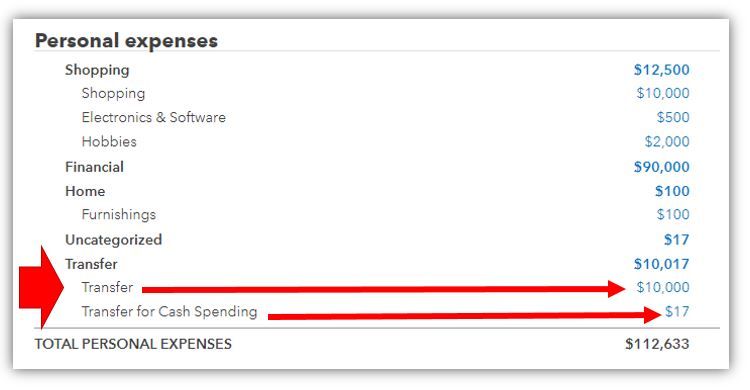

Owners equity owners investment or owners draw. Select Petty Cash or Owners Draw depending on the method you want to use to track funds. If you own a business you should pay yourself through the owners draw account.

This tutorial will show you how to record an owners equity draw in QuickBooks OnlineIf you have any questions please feel free to ask. Click the Account field drop-down menu in the Expenses tab. Under category select the owners equity account then enter the.

If youre the business owner and want to record an owners draw youll basically want to write the check out to yourself like you are paying yourself with a check. The information contained in this article is not tax or legal advice and is. Enter the contribution amount in the balance field.

Quickbooks bookkeeping cashmanagementIn this tutorial I am demonstrating how to do an owners draw in QuickBooks------Please watch. An owners draw is an amount of money an owner takes out of a business usually by writing a check. It is important to note that sole proprietors are paid with an owners draw instead of employee paychecks.

Open the chart of accounts and choose Add Add a new Equity account and title it Owners Draws If there is more than one owner make separate draw accounts for each owner and name them by owner eg. An owners draw account is an equity account in which QuickBooks Desktop tracks withdrawals of the companys. An owner of a sole proprietorship partnership LLC or S corporation may take an owners draw.

You need to refer to these following steps. Httpintuitme2PyhgjfIn this QuickBooks Payroll tutoria. In QuickBooks Onlines owners draw account company assets are used to pay an owner by tracking withdrawals.

Under account type select equity. You will pay the owner using an owners draw account. Patty could withdraw profits generated by her business or take out funds that she previously contributed to her company.

An owners draw refers to an owner taking funds out of the business for personal use. In the window of write the cheques you need to go to the Pay to the order section as a next step. Set up draw accounts.

From the PAY TO THE ORDER OF field select the vendors name. When I want to take money from the company I. When income is earned by an s.

To record a transaction between the business and owners account go into the Banking menu in Quickbooks and select the option titled Write Checks. If youre a sole proprietor you must be paid with an owners draw instead of employee paycheck. From the Detail Type drop-down choose Owners Equity.

How To Record An Owner S Draw The Yarny Bookkeeper

How To Pay Invoices Using Owner S Draw

How To Pay Invoices Using Owner S Draw

How To Record Owner Investment In Quickbooks Updated Steps

How To Setup And Use Owners Equity In Quickbooks Pro Youtube

Quickbooks Tip Applying Owner S Time For Job Costing Long For Success Llc

Solved Owner S Draw On Self Employed Qb

How To Record Owner S Equity Draws In Quickbooks Online Youtube

Setup And Pay Owner S Draw In Quickbooks Online Desktop

How To Set Up Record Owner S Draw In Quickbooks Online And Desktop

Quickbooks Online Plus 2017 Tutorial Recording An Owner S Draw Intuit Training Youtube

How To Set Up Owners Draw In Quickbooks Guide Smb Accountants

Quickbooks Owner Draws Contributions Youtube

Owner S Draw Quickbooks Tutorial

Solved Owner S Draw On Self Employed Qb

How Do I Make A J E With A Cr To Owner S Draw And Properly Record It In Cog Sold I Am Using Qbo Adv I Bought Items With My Personal Money That

Quickbooks Learn Support Online Qbo Support How To Set Up An Owner S Draw Account In The Chart Of Accounts